Financial and Investment

Our aim is to provide clear and transparent information regarding our financial position, fees, investment philosophy, and performance. Additional information is available through Brian Hamilton, our Chief Financial Officer.

Financial Information

Read our 2020 Annual Report here.

Account Management and Administrative Fees

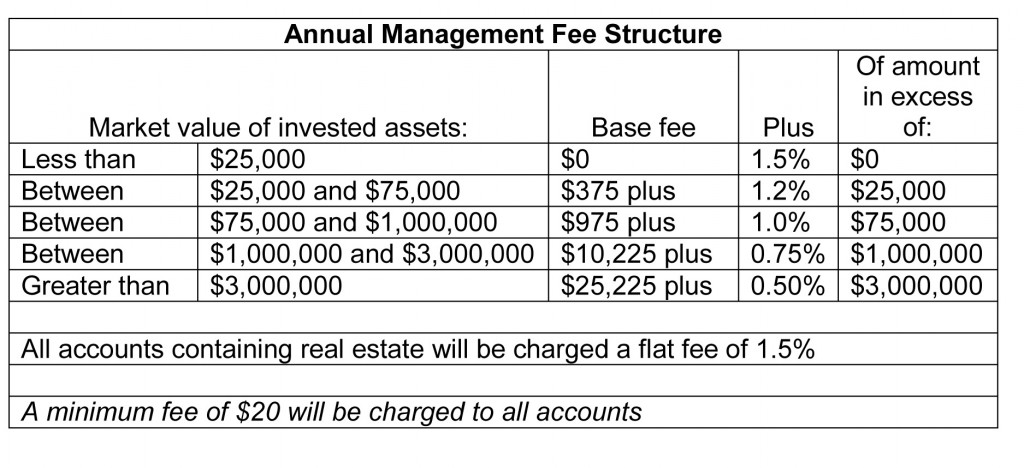

Legacy Deo’s operations are funded by account management fees, gifts and bequests, interest and dividends generated by invested reserves, administrative fees, and financial support from the Texas District of The Lutheran Church—Missouri Synod. Our fee schedule is as follows:

Account Management

Marketable Securities Gifts

One-time gifts are charged $25 to receive, sell, and distribute the net proceeds. This amount includes up to three distributions to external ministries or charities. An additional fee of $10 per distribution is charged when the number exceeds three. Statutory fees charged by securities brokers are netted against the proceeds prior to distribution.

For recurring gifts, we require a pass-through trust account to be opened. A one-time fee of $50 is charged to open the account, which also covers processing the first gift transaction. Subsequent gifts incur fees at the same rate as one-time gifts. A minimum balance of $250 is required to maintain an active pass-through trust. Upon closure of the account, this minimum balance is passed through to the final ministry or charity.

Estate Administration

Real Estate Sale

Tax Preparation

Most trusts require preparation of an annual tax return. Our base fee is $85, which includes preparation of taxpayer forms such as K-1 and 1099. Complex returns requiring additional preparation time are charged a minimum of $125.

Legal Services

Investment Information

Read our investment policy statement here.

Legacy Deo is pleased to offer our clients five investment funds having distinct return objectives. Two cover the full spectrum of fixed income securities, two address different equity strategies, and one provides non-correlated assets as an alternative to traditional investments. Each fund is professionally managed by one or more firms in concert with our investment consultant, Graystone Consulting – a business of Morgan Stanley. Assets are held through our Morgan Stanley brokerage relationship.

A summary by investment fund is as follows:

| Objective | Investment Types | Management Firm(s) |

|---|---|---|

| Fixed Income | Corporate bonds US Treasuries and agencies Corporate asset-backed securities Bond mutual funds (all rated AAA to BBB) | Sage Advisory Services |

| Equity Growth | Growth-oriented stocks Equity ETFs | Janus Henderson Lazard PGIM |

| Equity Dividend | Dividend-paying stocks Equity ETFs | Bahl & Gaynor, Inc. Cambiar Investors Silvercrest Asset Management |

| Higher-Yield | Bond mutual funds Real estate investment trusts (some rated BB and below) | Various mutual fund families |

| Liquid Alternatives | Energy-sector MLP mutual funds Global infrastructure Managed futures | Alkeon Capital Management KKR Millennium International Ltd. Shannon River Capital Management Various mutual fund families |

Allocation to these funds is dependent upon the objective of the underlying account, its distribution time horizon, and input from the accountholder. By varying the degree of allocation to the underlying funds, we are able to create portfolios that range anywhere from conservative to aggressive. Our investment philosophy is different than that of the typical individual investor, who tends to focus mainly on accumulation. Because Legacy Deo is in a perpetual phase of distribution, our orientation is toward long-term capital preservation and reasonable risk-reward tradeoffs.